Digitalization in the Finance Industry of the US: An Insight

Digitalization in Finance Industry of the US: An Insight Keeps You Growing

According to www.selectusa.gov, the US banking system had $17.9 trillion in assets and a net income of $236.8 billion by the end of 2018. The finance sector in the US supports the world’s largest economy, with the greatest diversity in banking institutions and concentration of private credit.

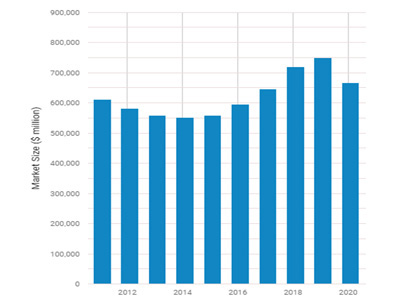

Here’s an overview of the market size of commercial banking in the US: Top 5 Things to Remember

How? Let’s have a look.

According to IBIS, the commercial banking in US market size is expected to be around $681.4 billion in 2021, which is a 2.3% growth in the market size compared to the previous year.

Also, during the financial term 2017-18, the finance and insurance sector added up to 7.4% (or, $1.5 trillion) of US gross domestic products. Such a high-growth sector automatically results in high job opportunities, both directly and indirectly.

From phone apps to home automation to cashless commerce and even beyond that, digital interpretation is the new norm for all vast markets today. But, how could that transform the industry of finance in any way? In every way, actually!

1. A few predictions that may completely take over the finance industry of the US in the next 5-10 years include the following:

- With automation and blockchain reaching deeper into finance operations, transactions will have become more or less entirely touchless.

- As operations will have become mostly automated, the finance sector will have doubled itself in terms of business insights and their services.

- Skillsets required by financial professionals will have also evolved dramatically, with the collaboration of man and technology at the workplaces.

- Finance will be available in the real-time, with self-service being the new norm. New service-delivery models will have emerged alongside robots and algorithms joining a more diverse finance workforce, including freelancers, and many more.

- Big vendors will be prepared with the help of finance applications and micro-services, which will set new challenges for traditional ERPs.

- Data standardization will have become more achievable with the help of APIs, although the data mess created previously may require more struggles to be entirely cleared.

- With new strategies explored, examined and executed, employees will get to do new things in new ways. In fact, employing workers considering the near future in today’s time will help balance the pace through the long term.

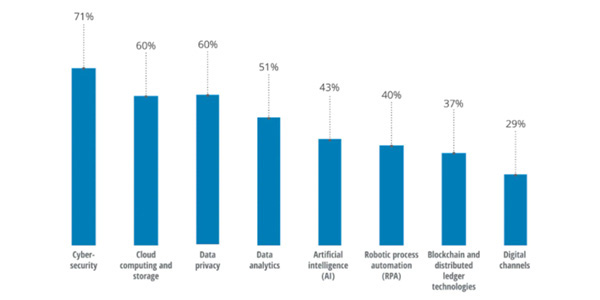

2. Here’s an insight on banks planning to invest on technology in 2021:

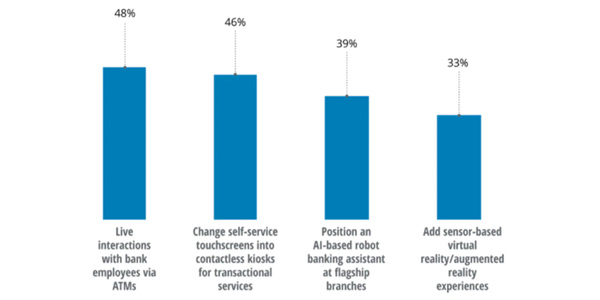

3. Here’s an insight into how a few banks plan to add digital capabilities to certain branches over 2021:

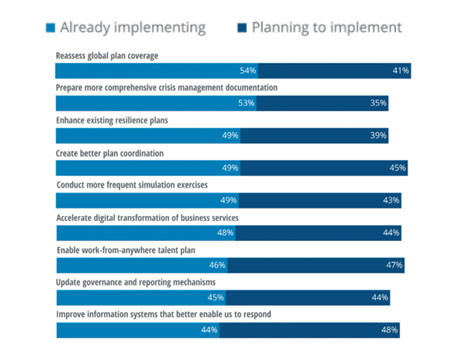

The banking industry’s collective response the pandemic crisis so far has been noteworthy. Going completely virtual and executing untested operating models smoothly within weeks was not as easy as it sounds.

4. how are banks maintaining resilience through the global pandemic?

The potential of digital banking, too, was never fully realized until the pandemic set the standards high for digitalization in Finance Industry of the US. Of course, the banking sector would benefit largely if customers transitioned into an all-digital market and self-service, which could bring down on costs significantly.

5. So, how can banks plan for a more loyal market in the digital world?

First of all, banks must prioritize retaining all first-time users of their digital channels with the help of targeted offers and engagement strategies. And, digital marketing will help augmenting these promotions to reach out to the respective target audience. Further, spreading awareness about incorporating AI-based banking assistants and sensor-based or virtual reality experiences will also help fetch in more confident and safety-cautious crowds during this pandemic crisis period.

Secondly, engaging customers in better debt management campaigns strategically and educating them on ideal debt management practices could help generate and strengthen trustworthy relationships. Empathetic procedures of debt collection could also add to crowd-retaining strategies in digital marketing.

Thirdly, banks may need to bring changes or completely transform their talent strategies to enable employees to learn better, faster, and more efficiently. While online programs and training sessions are more on-the-go nowadays, a primary focus on mental tools e.g., “Learning How to Learn” and learning from experiences will help develop more flexible, self-organizing teams. And to make them come together for a common purpose is where digital marketing plays a vital role.

Introducing new visionaries and spreading the word through digital marketing could help gain authority and transparency in certain cases of promotional strategies. For example, if a bank plans on implementing financial back-ups for start-up associations, digital marketing itself might lead the forefront for the bank’s new venture. Being technology-driven and having the capability to reach out to a wide target audience within a short time, builds trust and confidence among such start-up enthusiasts and retains them for future investment opportunities too.

While the CFO (Chief Finance Officer) and other high-ranking senior executives would require more in-depth tracking insights about the functioning and operations in respective banking segments if the industry becomes entirely digitalized, these tasks would be easier with a more sorted and easily trackable data storage system. These records would also help provide personalized services to customers for a more satisfying banking experience. All this, plus a well-executed campaign that speaks of authenticity empathetically, would result in more customer engagement, as this industry is one that is centered around trust.

The downside of the finance industry is that many people break into the career by working as tellers and customer-service designations, which are not very pleasing for introverts. The push to promote sales and increase revenues through cross-selling may also not be a very pleasing task for the newcomers. Through digitalization in Finance Industry, such employee experiences can be entirely eliminated. And, such improvisation measures can be largely communicated to those aspiring to join service will be magnified and multiplied with the intervention of digital marketing. From high-ranking officials to common employees to aspiring candidates and finally satisfied customers-all individuals down the chain in the finance industry will be largely benefitted with digital marketing.

SSMD Pte Ltd,, June 13, 2021